Twitter Feed

Cloud Computing as a Strategic Asset

For some reason, this week seems to have more in it than most. While the steady stream of briefing request seem to be increasing, the post briefing discussions also seem…

Vivek Kundra: “Engage the American People in their Daily Digital Lives”

Today I attended a very impressive talk by the Federal CIO, Mr. Vivek Kundra at a Northern Virginia Technology Council Public Policy event. His open and “matter of fact” approach…

McKinsey vs. Booz Allen Hamilton !

A community skirmish reminiscent of the recent “manifestogate” has apparently erupted around the McKinsey & Co. report “Clearing the air on cloud computing“. Booz Allen Hamilton Principals Mike Cameron and…

Oracle Buys Sun!!

Swooping in from nowhere, Oracle buys Sun for $7.4B!! “This morning, the companies announced that they’d struck a deal worth $7.4 billion or $5.6 billion net of Sun’s cash and…

Aneesh Chopra Nominated For Federal CTO

Although Aneesh Chopra is a new name for most, he is well know in Virginia as Governor Tim Kaine’s Secretary of Technology. For the Commonwealth, he was charged with leading…

Could Cloud Computing Cost More?

In a recent conference, analyst William Forrest says that large companies could end up paying more than twice as much by using cloud based services. According to a Forbes.com report,…

Cisco’s Cloud Computing Strategy

A couple of weeks ago, Krishna Sankar provided a glimpse into Cisco’s cloud computing strategy in a presentation titled “A Hitchhiker’s Guide to the Inter-Cloud” . The presentation outlined the…

NCOIC and Cloud Computing: An Update

As the NCOIC gets it’s arms around this new paradigm, the Cloud Computing Working Group has focused on establishing a roadmap for providing value to the industry. Using the established…

SUN-IBM Talks Breakdown

As reported in multiple sources today, including Reuters, Sun has apparently rejected a purchase offer by IBM. “Shares of Sun Microsystems Inc tumbled 22.5 percent after it rejected a $7…

Former DoT CIO on Cloud Computing

Last month, former Transportation Department CIO Dan Mintz offered his views on cloud computing to Eric Chabrow, Managing Editor of Government Information Security. According to Mr. Mintz, there is currently…

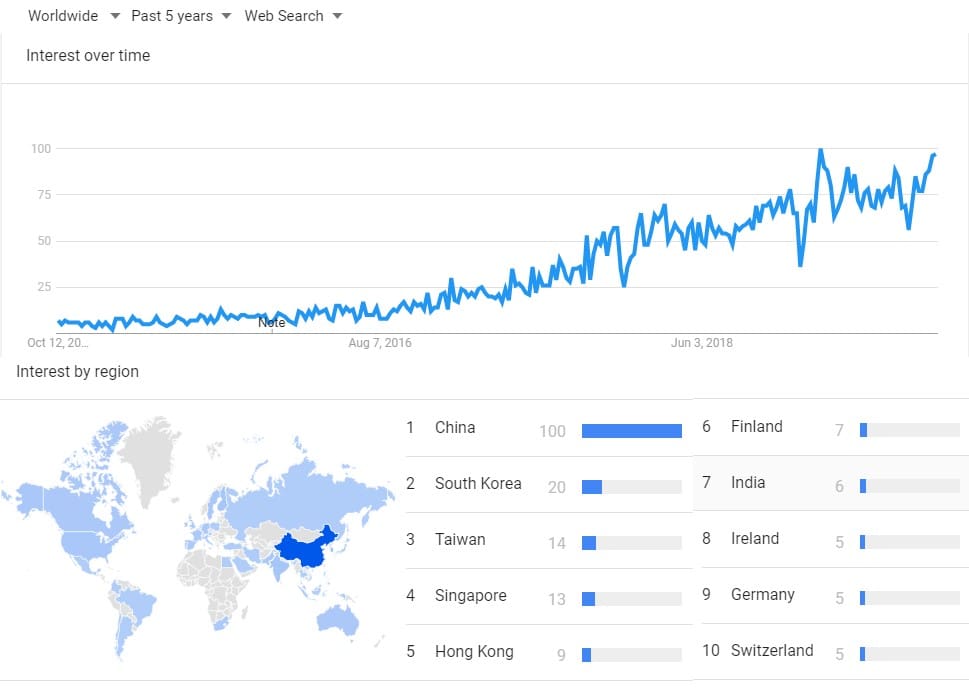

Edge computing provides compute, storage, and networking resources close to devices generating traffic. Its benefits are based on an ability to provide new services capable of meeting stringent operational requirements by minimizing both data latency and the need for bandwidth. Based on Google trend data, searches for the term has also grown substantially over the past five years.

Recognizing that web searches are not (yet) the arbiter of all things real, it does indicate a rapid growth of interest in the term. Observations of the information technology industry show a similar trend among application developers, particularly those working in manufacturing, gaming, AR/VR, and automotive. Their work seems focused on the exploration of quite a few significant business opportunities arising from the introduction of edge computing and 5G. Communication service providers are also mimicking the interest by evolving their centralized NFV infrastructure to distributed cloud infrastructure to build out edge clouds handling telecom applications and third-party applications.

While all this activity does support the potential of edge computing and 5G, essential questions remain regarding the potential versus the reality of edge computing. This query was the focus of an Ericsson Digital webinar presentation by João Monteiro Soares, Strategic Solution Manager, Distributed Cloud Ericsson and Alan Evans, Senior Director of Innovation Strategy at Edge Gravity.

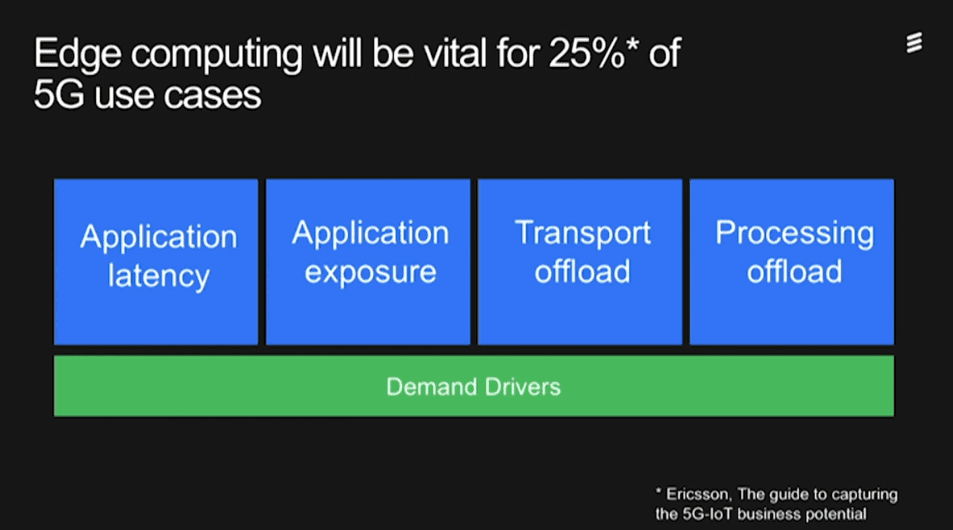

These two industry experts focused on four key areas:

- The value of edge computing to 5G networks;

- Service provider business growth;

- Industry early adopter use cases; and

- Profitable service provider business strategies.

Ericsson projects that this segment will draw 25% of a US$14B-US$129B 5G revenue opportunity anchors their edge computing profitability argument.

Realized numbers depend on specific industry solutions and the rate of user adoption. They argued that telecommunications providers are key players in getting the solutions in place through the investment decisions they make today on testing and validation of relevant technologies, concrete business cases, and business model feasibility. Experiments should be executed to determine the:

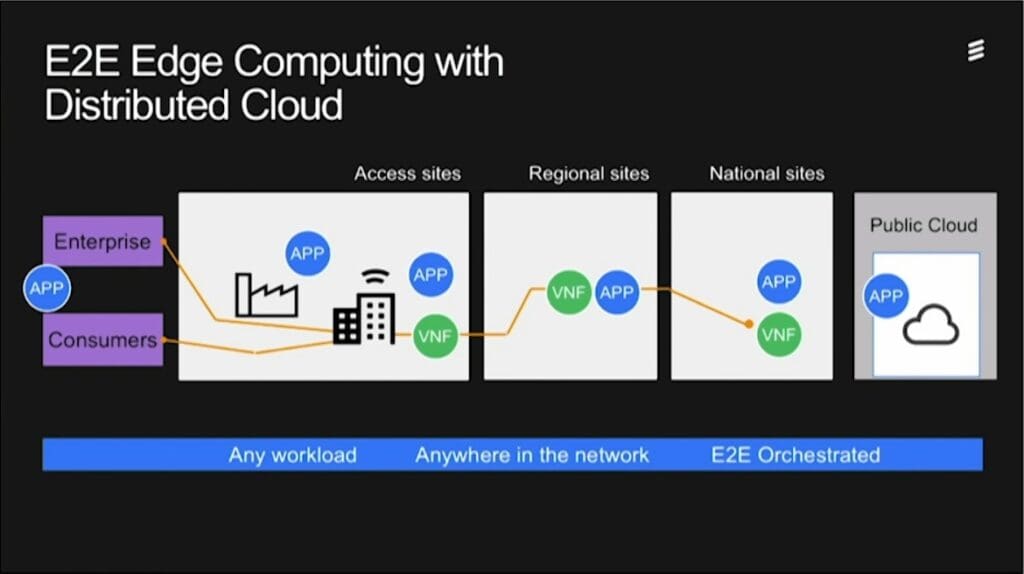

- architectural positioning of industry dependent workloads;

- extendibility of centralized national architectures to regional and local access sites;

- deployment of NFVI centralized clouds throughout the network and to the edge;

- pros and cons of centralized services from a distributed cloud; and

- end-to-end service provider execution environment.

All of these functions require network transformation and a concerted collaboration effort around building broader, industry vertical ecosystems. All of these activities represent significant departures from the traditional telecommunications sales approach based on capital expenditure and acquisition of industry vertical appliances.

Early adopters of edge computing have discovered that the more lucrative path is towards the provisioning of industry vertical tailored on-demand services that are tempered by various maturing technologies and regulatory environments. This future state supports the operational expenditure of funds by telco customers for the consumption of virtual resources. From an infrastructure perspective, the goal should be establishing a virtualized mobile core in a true cloud-native manner. Customization, network slicing, and infrastructure platform services will all combine to enable service providers to deliver solutions across all multiple verticals, leading ones of which include:

- Gaming and entertainment;

- AR/VR Mixed Reality;

- Critical IoT;

- Smart Manufacturing; and

- Smart Automotive

To monetize future business models, service providers need to innovate towards the delivery of new services. This journey argues for a platform that is also open to innovation by third parties on top of the foundational network. Service aggregation and revenue sharing are also critical components of these new business models. Telco service provider strategies should encompass both a global industry ecosystem positional view and a local service focus on enhanced regional bandwidth and latency reduction. Technology development remains essential, but it needs to take a back seat to strategic business development activities. This challenging path requires real cultural change that counters the historic technology focus and embraces industry vertical competence and values extended vertical industry ecosystems.

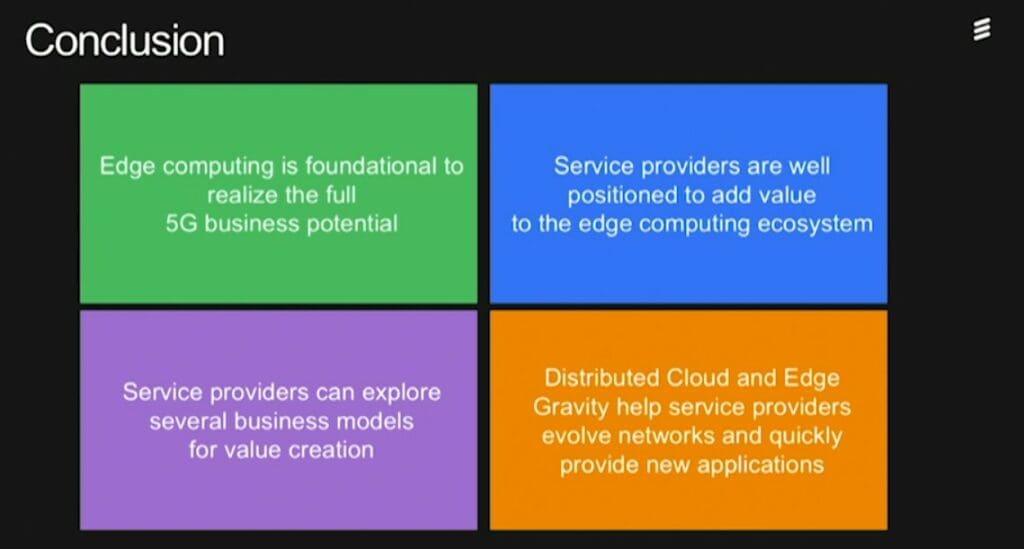

Seventy to eighty percent of the required technology seems to be in place. The remaining technological requirements are determined through industry vertical use case testing across live 5G network environment. I came away from the webinar fully convinced that edge computing is indeed a real opportunity. Revenue and profit realization, however, requires joint development of industry-focused ecosystems by business application developers and telecommunications providers. They must establish joint strategies and specific use case roadmaps today or risk being left behind by their competition. The upcoming SDN World Congress promises to be a crucible for the development and testing of profitable edge computing business models. I can’t wait to find out more about how the most innovative service providers use Ericsson solutions to establish their leadership in this brave new world.

Cloud Computing

- CPUcoin Expands CPU/GPU Power Sharing with Cudo Ventures Enterprise Network Partnership

- CPUcoin Expands CPU/GPU Power Sharing with Cudo Ventures Enterprise Network Partnership

- Route1 Announces Q2 2019 Financial Results

- CPUcoin Expands CPU/GPU Power Sharing with Cudo Ventures Enterprise Network Partnership

- ChannelAdvisor to Present at the D.A. Davidson 18th Annual Technology Conference

Cybersecurity

- Route1 Announces Q2 2019 Financial Results

- FIRST US BANCSHARES, INC. DECLARES CASH DIVIDEND

- Business Continuity Management Planning Solution Market is Expected to Grow ~ US$ 1.6 Bn by the end of 2029 - PMR

- Atos delivers Quantum-Learning-as-a-Service to Xofia to enable artificial intelligence solutions

- New Ares IoT Botnet discovered on Android OS based Set-Top Boxes